-

Postoffice Interest Calculator

- Category:Finance

- Updated:2024-08-02

- Rating: 4.1

Introduction

Introducing the Postoffice Interest Calculator app, the perfect tool for anyone looking to calculate their interest for various saving schemes. With a comprehensive knowledge base of historical interest rates, there's no need to remember complicated percentages. Simply enter the start date of your scheme, and the app will automatically provide the relevant interest rate. From Recurring Deposits to Monthly Income Schemes and Term Deposits, this app covers it all. Additionally, it also helps calculate taxable interest for income tax purposes, making it a must-have for financial planning. Please note that this app is not an official app from the Post Office, but it's a reliable and user-friendly alternative.

Features of Postoffice Interest Calculator:

* Comprehensive Knowledge Base: The Postoffice Interest Calculator app offers a wealth of information and historical interest rates for a variety of saving schemes. Users can easily access the app to find the most up-to-date interest rates for different schemes without having to search through multiple sources.

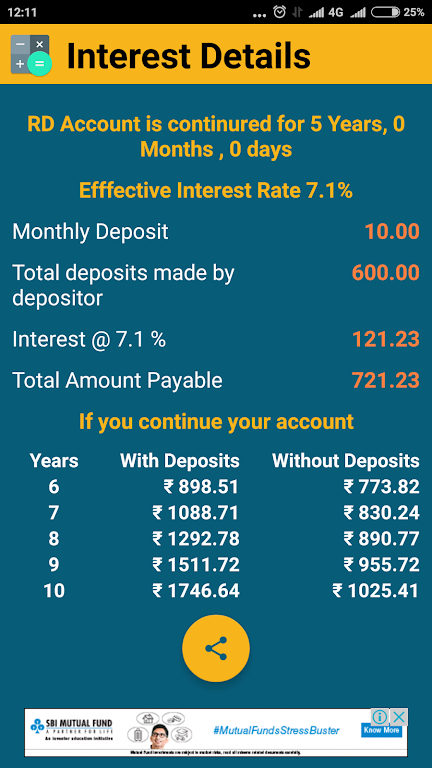

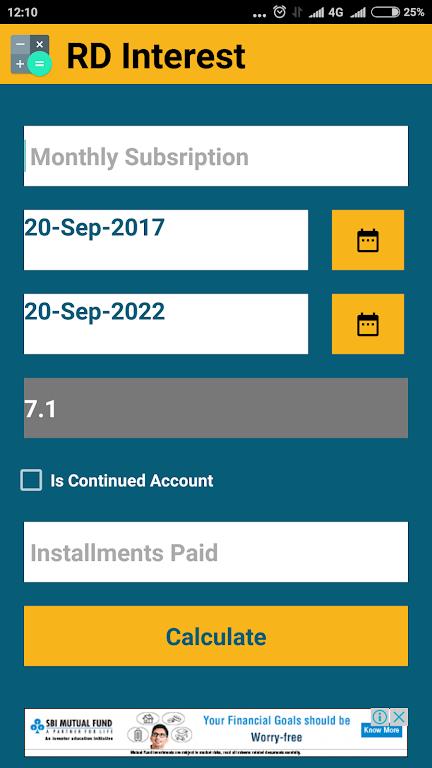

* Automatic Interest Rate Calculation: Users no longer need to remember interest percentages for different schemes. By simply entering the start date of their investment, the app will automatically calculate the applicable interest rate, ensuring accurate and efficient calculations.

* Wide Range of Saving Schemes: The app covers a diverse range of saving schemes, including Recurring Deposit (RD), Monthly Income Scheme (MIS), Term Deposit (TD), Senior Citizen Savings Scheme (SCSS), Kisan Vikas Patra (KVP), National Savings Certificates (NSC), Public Provident Fund (PPF), and SSY Sukanya Samriddhi Yojana (SSA). This comprehensive coverage ensures that users have access to all the information they need for any saving scheme they choose.

* Tax Calculation Support: In addition to calculating interest rates, the app also provides support in calculating taxable interest for the financial year. Users can easily determine the income tax for schemes such as NSC, SCSS, TD, and MIS, making it a convenient tool for financial planning.

Tips for Users:

* Keep the App Updated: To ensure accurate calculations and access to the latest interest rates, it is essential to keep the Postoffice Interest Calculator app updated. Check for regular updates and install them promptly to enjoy the full benefits of the app.

* Double-Check Start Dates: When inputting the start date of an investment, it is crucial to double-check and ensure its accuracy. Any errors in the start date could result in inaccurate interest rate calculations, leading to incorrect financial planning.

* Explore Different Schemes: Take advantage of the wide range of saving schemes covered in the app. Each scheme has its own unique advantages and interest rates, so explore different options to find the ones that best suit your financial goals.

Conclusion:

With the Postoffice Interest Calculator app, users can access a comprehensive knowledge base of interest rates for various saving schemes. The automatic interest rate calculation feature eliminates the need for users to remember specific percentages, making financial planning hassle-free. The app covers a wide range of saving schemes and even provides support for calculating taxable interest, offering a one-stop solution for all financial calculations. Keep the app updated, double-check start dates, and explore different schemes to maximize the benefits of using the Postoffice Interest Calculator app.

Information

- Size: 5.20 M

- Language: English

- Version: 3.2.4

- Requirements: Android

- Ratings: 23

- Package ID: relicusglobal.com.pointerestcalculator

- Developer: RelicusApps