-

Bettr Card: Credit Reimagined

- Category:Finance

- Updated:2024-08-09

- Rating: 4.1

Introduction

Introducing Bettr Card: Credit Reimagined, a revolutionary credit solution designed to reimagine the way we handle credit. Issued by SBM Bank (India) Ltd in partnership with Bettr Credit, this app aims to enable financial success for the next billion by providing simple, transparent, and timely access to quality credit. With Bettr Card, you have the power of a credit card in both the physical and virtual worlds, always with you in your wallet and on your phone. Whether you're looking to spend, save, or grow financially, Bettr Card is designed for those who believe in being financially smart.

Features of Bettr Card: Credit Reimagined:

> Instant Approval and Ready-to-Use Digital Card: It offers instant approval and provides a digital card that is ready to use immediately. No long waits or complicated processes.

> Works Everywhere with the Power of Visa Platinum: It offers the convenience of being accepted everywhere Visa Platinum is accepted, giving users the freedom to make purchases both online and offline.

> Lower Interest Rates and Interest-Free Period: Enjoy lower interest rates starting at 49% per month and take advantage of up to 51 days of interest-free period, allowing you to save money on interest charges.

> Cashback on ALL Spends: With it, you can receive 1% cashback on all your spends, giving you the opportunity to earn rewards while making your everyday purchases.

> Credit Limit Upgrades and Interest Rate Reductions: It guarantees credit limit upgrades and interest rate reductions every six months when timely payments are made, rewarding responsible financial behavior.

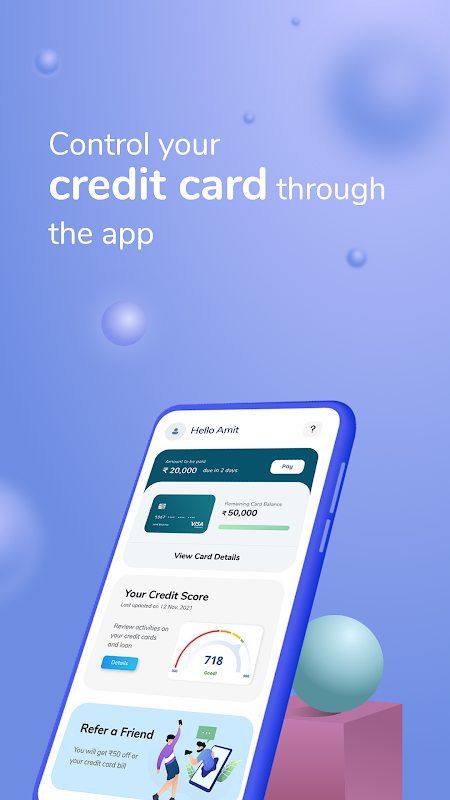

> Simple and Secure Mobile App: It offers a user-friendly mobile app that allows you to quickly view your balance, make bill payments, and redeem rewards. The app also provides smart statements with no complicated jargon, making it easy for users to manage their finances.

FAQs:

> How long does it take to get approved for a Bettr Card?

A: It offers instant approval, so you can receive your card and start using it immediately after the application process.

> Can I use it for online purchases?

A: Yes, it works both online and offline, giving you the flexibility to make purchases in any situation.

> Is there an annual fee for the Bettr Card?

A: There is no information on the presence of an annual fee for the Bettr Card in the provided text.

> How can I redeem the cashback rewards earned with it?

A: The mobile app allows you to easily redeem your cashback rewards, making it convenient to access the benefits of your spending.

Conclusion:

With its instant approval, lower interest rates, cashback rewards, and user-friendly mobile app, Bettr Card: Credit Reimagined offers a compelling credit card option for those looking to be financially smart. The ability to use the card both online and offline, along with the guarantee of credit limit upgrades and interest rate reductions, further enhances its appeal. With it, users can easily manage their finances, track their spendings, and enjoy rewards, all while feeling secure with the card's safety features. Start your credit-building journey and experience the benefits of the Bettr Card today.

Information

- Size: 28.60 M

- Language: English

- Version: 1.9.7

- Requirements: Android

- Ratings: 51

- Package ID: com.mvalu.customer

- Developer: mvalu