-

TachyLoans - Instant Loan for Education

- Category:Finance

- Updated:2024-08-12

- Rating: 4.3

Introduction

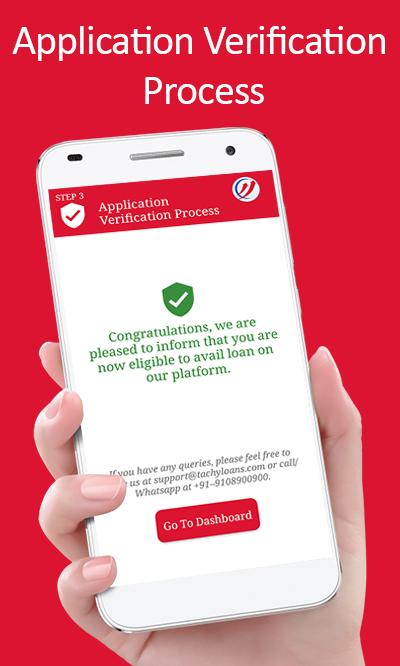

Introducing TachyLoans - Instant Loan for Education, the app that provides you with instant loans for all your education needs. Whether you need to finance school or college fees, professional certifications, or skill development courses, TachyLoans has got you covered. As one of India's top education loan providers in partnership with leading banks and NBFCs, TachyLoans offers collateral-free loans with interest rates starting at an incredible 11.50%. With our complete digital experience, you can apply for a loan and receive disbursed funds without ever leaving your home.

Features of TachyLoans - Instant Loan for Education:

> Flexible EMI Tenures: It offers flexible EMI tenures ranging from 6 to 36 months. This allows borrowers to choose a repayment plan that suits their financial situation.

> Loan Amounts: It provides loan amounts, catering to a wide range of educational expenses.

> Collateral-Free Loans: One of the standout features of TachyLoans is that it offers collateral-free loans. Borrowers do not need to provide any security or collateral to avail of the loan.

> Direct Disbursement to Educational Institute: It simplifies the loan process by directly disbursing the loan amount to the school or educational institute. This eliminates the need for borrowers to handle the funds themselves.

> Easy Repayment through NACH: It offers easy repayment options through the National Automated Clearing House (NACH). Borrowers can conveniently set up automatic monthly payments from their bank account.

> Wide Availability: TachyLoans' services are available in over 100 cities in India, making it accessible to borrowers across the country.

Tips for Users:

> Compare EMI Tenures: Before taking a loan, compare the EMI tenures offered by TachyLoans. Choose a repayment period that aligns with your financial capabilities, ensuring you can comfortably pay off the loan.

> Determine Loan Amount Required: Assess the educational expenses you need to cover and determine the appropriate loan amount. TachyLoans offers a range of loan amounts, so it's essential to choose the amount that fits your needs without burdening yourself with excessive debt.

> Gather Required Documents: Ensure you have all the necessary documents ready before applying for a loan. This includes PAN card, address proof, selfie, bank statements, and payslips. Having these documents prepared will expedite the loan application process.

> Understand Fees and Charges: Familiarize yourself with the processing fee of 2% and the applicable GST. Knowing the fees and charges associated with the loan will help you make an informed decision.

Conclusion:

TachyLoans - Instant Loan for Education offers a comprehensive and convenient solution for individuals seeking financial assistance for educational purposes. With flexible EMI tenures, collateral-free loans, and direct disbursement to educational institutes, TachyLoans simplifies the borrowing process. The availability of the service in over 100 cities in India ensures that borrowers from various locations can benefit from TachyLoans' services. By prioritizing data security and privacy, TachyLoans reassures borrowers that their information is protected. Download the TachyLoans Education Loan app now and embark on your educational journey hassle-free.

Information

- Size: 5.90 M

- Language: English

- Version: 1.62

- Requirements: Android

- Ratings: 30

- Package ID: com.tachyloans

- Developer: FinMomenta Pvt Ltd