-

Speed Finance Loan App लोन ऐप

- Category:Finance

- Updated:2024-08-12

- Rating: 4.2

Introduction

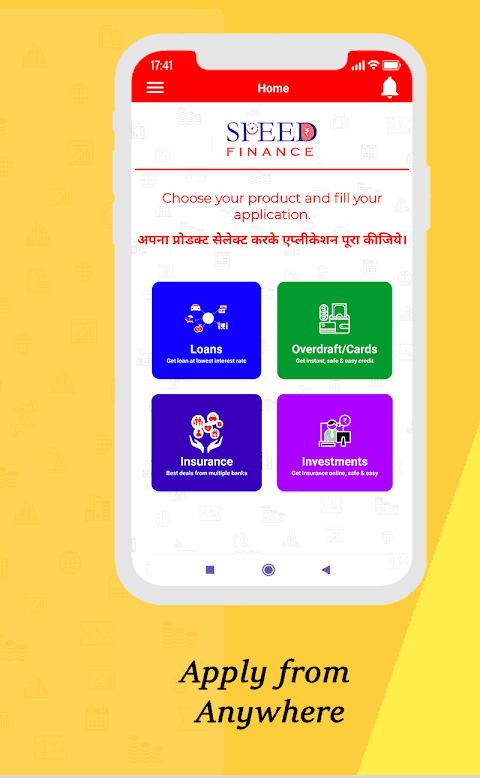

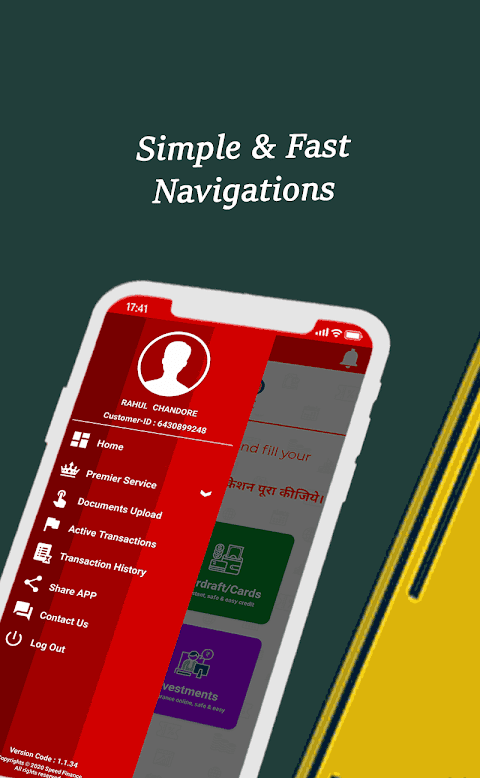

Introducing Speed Finance Loan App लोन ऐप, the ultimate solution for all your personal loan needs. As a leading provider in India, Speed Finance offers the easiest way to avail a personal loan. With this app, you can now get the best personal loan from top banks and NBFCs, all at your fingertips. What sets Speed Finance apart is its transparent fee and charges structure, with interest rates ranging from 12% to 29.95%. Whether you're a low-risk or high-risk customer, there is a processing fee that caters to your specific needs. With varying repayment tenures and penalty charges for delayed payments, Speed Finance ensures flexibility and convenience for its valued customers.

Features of Speed Finance Loan App लोन ऐप:

> Easy and Convenient Personal Loans: Speed Finance Loan App लोन ऐप offers the easiest way to avail a personal loan. With just a few simple steps, users can apply for a loan and get the funds they need without any hassle.

> Competitive Interest Rates: Speed Finance provides personal loans with interest rates ranging from 12% to 95%. This ensures that users can find a loan that suits their financial needs and offers a competitive interest rate.

> Transparency in Fees and Charges: The app clearly states the fees and charges associated with the loans. A small processing fee is charged based on the customer's risk profile, ensuring transparency and fair practices.

> Flexibility in Repayment Tenures: Speed Finance Loan App लोन ऐप understands that each individual has different repayment abilities. Therefore, they offer flexible repayment tenures that cater to customers' specific needs and financial situations.

Tips for Users:

> Compare Interest Rates: Before applying for a personal loan, it is recommended to compare the interest rates offered by different banks and NBFCs through the Speed Finance app. This will help users choose the best loan option with the most favorable interest rate.

> Evaluate Eligibility: Users are advised to check their eligibility criteria before applying for a loan. By providing the required documents such as salary slips and passport photo/selfie, users can ensure a smoother loan approval process.

> Understand Fees and Charges: It is essential to carefully read and understand the fees and charges associated with the loans before proceeding with the application. This will help users make an informed decision and avoid any surprises later on.

Conclusion:

Speed Finance Loan App लोन ऐप provides a seamless and convenient borrowing experience. With attractive features like easy loan access, competitive interest rates, transparent fees, and flexible repayment tenures, Speed Finance stands out from its competitors. By following the playing tips of comparing interest rates, evaluating eligibility, and understanding fees and charges, users can make the most of the app's offerings and secure the best personal loan for their financial needs. Download Speed Finance now to unlock a world of borrowing possibilities.

Information

- Size: 16.00 M

- Language: English

- Version: 1.1.72

- Requirements: Android

- Ratings: 76

- Package ID: com.earnwealth.b2c

- Developer: EarnWealth Solutions Pvt Ltd