-

LoanSimple - Small Business Loans, No Collateral

- Category:Finance

- Updated:2024-08-12

- Rating: 4

Introduction

Introducing LoanSimple - Small Business Loans, No Collateral, the innovative app that helps small businesses thrive by providing fast and hassle-free business loans. No need to worry about collateral or owning a home or business premises. LoanSimple offers credit lines of up to 5 lakhs with approval in just 48 hours. And the best part? Say goodbye to monthly EMIs and hello to daily repayments. With LoanSimple, your loan is automatically deducted on a daily basis straight from your bank account, making it easier than ever to stay on top of your payments.

Features of LoanSimple - Small Business Loans, No Collateral:

> Fast Approval: It offers approval within 48 hours, ensuring that you can get the funds you need quickly and efficiently. This allows you to seize opportunities and take action without the wait.

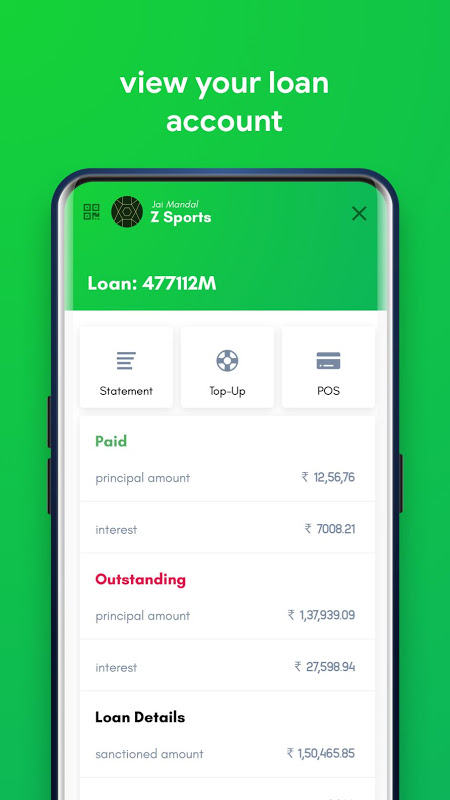

> Substantial Credit Line: With LoanSimple, you can access up to 5 lakhs of credit line, providing you with the financial flexibility to cover various business expenses, from inventory restocking to equipment purchases.

> Convenient Top-up Option: Need additional funds? It offers a top-up within 24 hours, allowing you to meet unexpected needs or scale your business operations without delay.

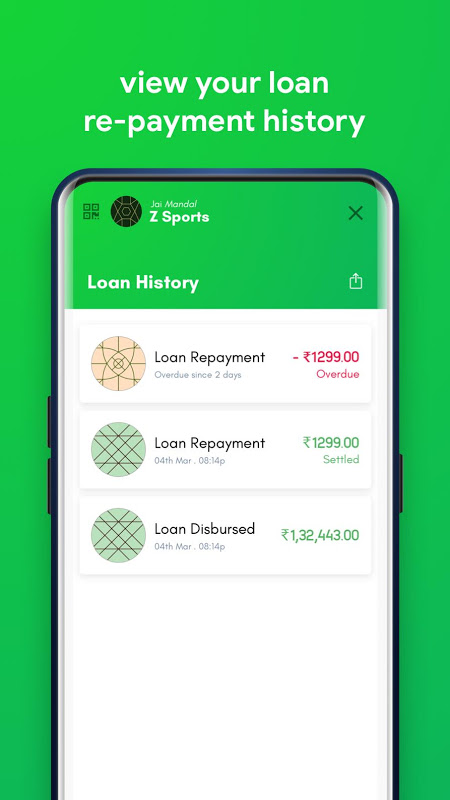

> Daily Repayments: No more worries about maintaining a minimum balance at the end of the month for paying EMIs. It simplifies the process with daily repayments, automatically deducting the loan amount from your bank account on a daily basis.

> No Collateral Required: Unlike traditional loans, it does not require you to provide any assets as security for the loan. This eliminates the need for home or business premises ownership, making it accessible to a wider range of borrowers.

> Minimal Documentation: It aims to simplify the lending process by requiring minimal documents. All you need is your PAN & Aadhaar, along with either 12 months bank statements or transactions/settlement screenshots of your QR Code GST return.

Tips for Users:

> Plan Ahead: Before applying for a loan, assess your business needs and determine the amount required. This will help you make informed decisions and ensure that you borrow an appropriate credit line.

> Keep Records Organized: It requires minimal documentation, so ensure that your PAN, Aadhaar, and bank statements/screenshots are readily available. Having organized records will make the application process smoother and faster.

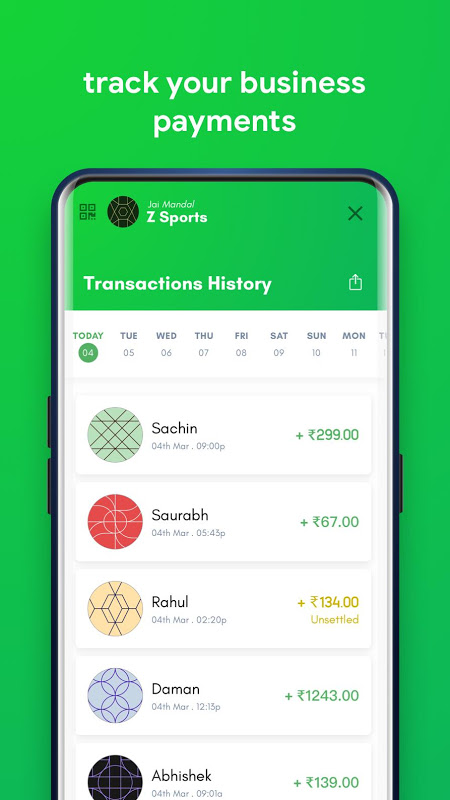

> Monitor Repayments: Stay on top of your daily repayments by regularly checking your bank account and ensuring sufficient funds. This will prevent any late or missed repayments, maintaining a good credit history and avoiding penalties.

Conclusion:

LoanSimple - Small Business Loans, No Collateral offers a range of attractive features that make it an appealing choice for small businesses. With fast approval, substantial credit line, convenient top-up options, daily repayments, no collateral requirements, and minimal documentation, LoanSimple provides a hassle-free and flexible borrowing experience. By following the playing tips of planning ahead, keeping records organized, and monitoring repayments, borrowers can effectively utilize LoanSimple to build and grow their micro businesses. Download LoanSimple now and take advantage of its benefits to drive the success of your business.

Information

- Size: 6.30 M

- Language: English

- Version: 3.1.8

- Requirements: Android

- Ratings: 82

- Package ID: in.loansimple.merchant

- Developer: LoanSimple (Unogrowth Technologies Pvt Ltd)