-

PM SVANidhi

- Category:Productivity

- Updated:2024-08-15

- Rating: 4.4

Introduction

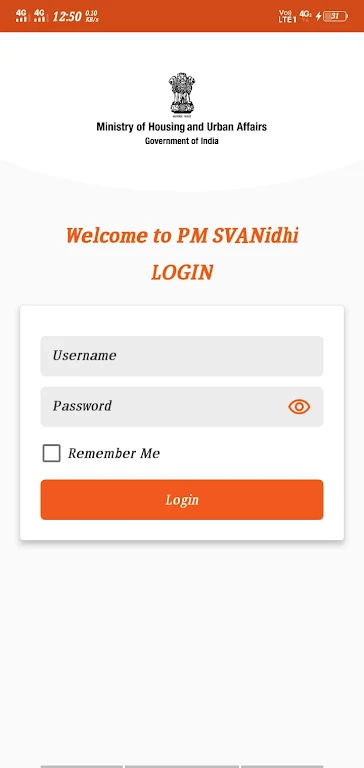

The PM SVANidhi – Official Mobile Application is a revolutionary tool that aims to empower street vendors and revive their businesses. This app provides a seamless solution for lending institutions such as banks, NBFCs, and MFIs to process loan applications for street vendors through their field agents. Launched by MoHUA, this initiative offers collateral-free working capital loans of up to ₹10,000 with a one-year tenure to around 50 lakh street vendors. To promote good repayment behavior and digital transactions, the scheme offers incentives like interest subsidies and cash-back rewards.

Features of PM SVANidhi:

⭐ Streamlined Loan Application Process: The app offers an end-to-end solution for Lending Institutions, making it easy for them to process loan applications of beneficiaries through their field agents.

⭐ Collateral-Free Working Capital Loan: Street vendors can apply for a collateral-free working capital loan, with a tenure of 1 year. This loan enables approximately 50 lakh street vendors to resume their businesses and become self-reliant.

⭐ Incentives for Good Repayment Behavior: The scheme provides incentives such as interest subsidy at a rate of 7% per annum and cash-back of up to ₹100 per month. These incentives promote good repayment behavior and digital transactions among the beneficiaries.

⭐ Next Tranche of Loan on Early Repayment: Beneficiaries who repay their loans early or on time are eligible for an enhanced next tranche of the loan. This encourages timely repayment and helps vendors build a positive credit history.

⭐ Inclusion of NBFCs and MFIs as Lending Institutions: The scheme maximizes its reach by including Non-Banking Financial Companies (NBFCs) and Microfinance Institutions (MFIs) as Lending Institutions. This provides more opportunities for street vendors to access loans and financial support.

⭐ Graded Guarantee Cover: Lending Institutions receive a Graded Guarantee Cover through CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) on a portfolio basis. This encourages lending and boosts the confidence of Lending Institutions in supporting street vendors.

Conclusion:

The PM SVANidhi simplifies the loan application process for street vendors, banks, NBFCs, and MFIs. With its collateral-free working capital loan, attractive incentives, and support for early repayment, the app empowers street vendors to resume their businesses and become self-reliant. The inclusion of NBFCs and MFIs as Lending Institutions expands the reach of the scheme, while the Graded Guarantee Cover ensures the confidence of Lending Institutions in providing financial support. Download the app now to access these benefits and transform your business!

Information

- Size: 21.10 M

- Language: English

- Version: 1.0.10

- Requirements: Android

- Ratings: 95

- Package ID: com.mohua.pmsvanidhi

- Developer: Ministry of Housing and Urban Affairs