-

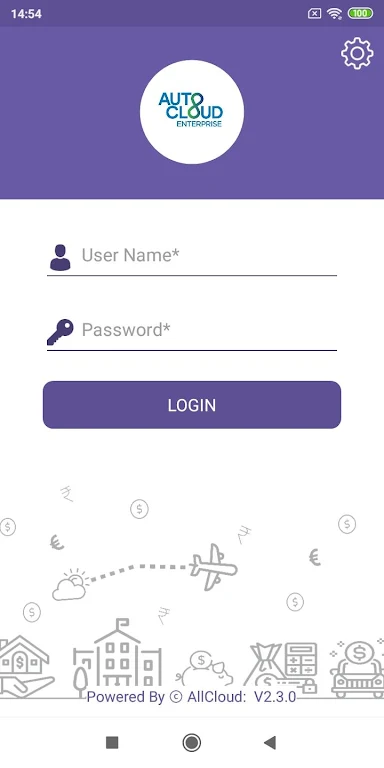

ACE Collect

- Category:Finance

- Updated:2024-08-16

- Rating: 4

Introduction

Introducing ACE Collect - the ultimate solution for lending institutions of all sizes. This cloud-based platform revolutionizes the borrowing process, allowing lenders to close loans quickly and streamline operations. With it, field collections become a breeze as it enables seamless data transfer to multiple collection agencies. The app provides a user-friendly dashboard for easy analytics, empowering lenders with valuable insights. Plus, it offers a range of functionalities, from accepting repayments and managing cash flow to generating receipts and keeping detailed field notes. Say goodbye to operational inefficiencies and embrace automation with it.

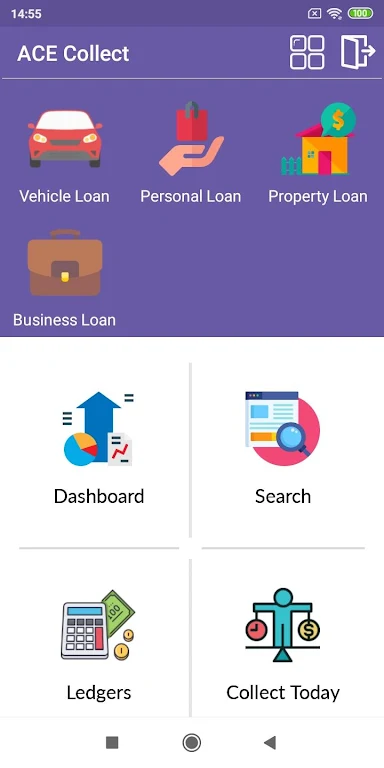

Features of ACE Collect:

* Simplified Borrowing Experience: ACE Collect simplifies the borrowing experience for both lenders and borrowers. By automating and streamlining the lending process, it enables lenders to close loans faster and reduces the operational inefficiencies typically associated with manual processes.

* End-to-End Cloud-based Platform: It is an end-to-end cloud-based lending platform. This means that users can access the platform from anywhere, at any time, as long as they have an internet connection. This flexibility and accessibility make it convenient for users to manage their collections and loan details on the go.

* Customizable and Configurable: The platform is highly customizable and configurable, allowing users to tailor it to their specific needs and preferences. Users can set up their own analytics dashboards, create reports, and configure cash management processes. This level of customization ensures that the platform aligns with the unique requirements of different lending institutions.

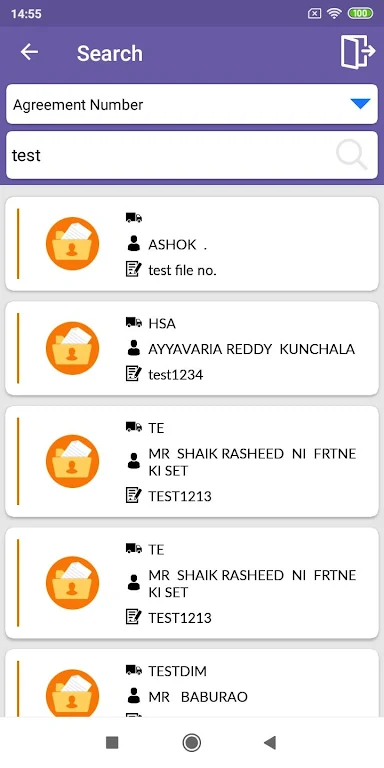

* Seamless Integration: It seamlessly integrates with various collection agencies, enabling users to effortlessly push collection data to these agencies. This integration eliminates the need for manual data entry and reduces the chances of errors or discrepancies in collection records.

FAQs:

* How can it benefit non-banking financial companies (NBFCs)?

It is designed to benefit NBFCs of any size by simplifying the borrowing experience, reducing operational inefficiencies, and providing comprehensive collection management capabilities. It streamlines loan closures, facilitates accurate loan tracking, and offers customizable analytics dashboards for better decision-making.

* Can it be accessed on mobile devices?

Yes, it can be accessed on mobile devices through its mobile app, which allows field collections, acceptance of repayments, printing of receipts using mobile Bluetooth printers, and note-taking on the field. This enhances the overall user experience and enables efficient collection management on the go.

* How secure is the it platform?

It prioritizes data security and ensures that user information is protected through robust encryption and data access controls. The platform is built on a secure cloud infrastructure that adheres to industry best practices to safeguard user data.

Conclusion:

ACE Collect offers a comprehensive and user-friendly solution for lenders, non-banking financial companies, small banks, private lenders, and finance companies. Through its simplified borrowing experience, customizable configuration options, seamless integration with collection agencies, and cloud accessibility, it maximizes efficiency and minimizes operational complexities. With its mobile app and strong focus on data security, it empowers lenders to effectively manage their collections anytime, anywhere. Whether it's loan tracking, cash management, or generating reports, it streamlines and automates crucial processes, enabling lenders to optimize their lending operations and enhance overall productivity.

Information

- Size: 51.50 M

- Language: English

- Version: 2024.02.09

- Requirements: Android

- Ratings: 6

- Package ID: com.AllCloud.ACEnterprise

- Developer: AllCloud Enterprise Solutions Pvt Ltd