-

PaySense Partner

- Category:Finance

- Updated:2024-08-30

- Rating: 4.2

Introduction

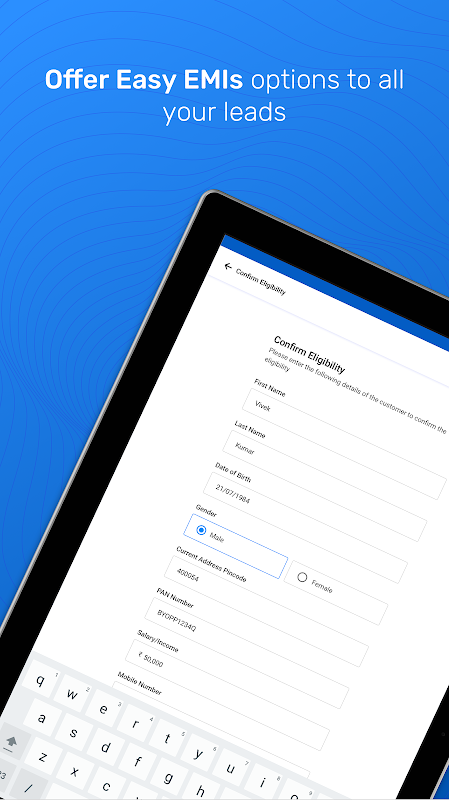

Introducing the PaySense Partner App, a groundbreaking tool that allows PaySense's partners to provide their customers with easy access to personal loans and financing options. With over 10,00,000 satisfied users already benefiting from PaySense personal loans, this app is revolutionizing the way individuals and businesses help their customers in times of need. Whether it's for medical emergencies, education expenses, marriage costs, or simply upgrading to new electronics, PaySense is there to help. The best part? No credit card or bureau score is required.

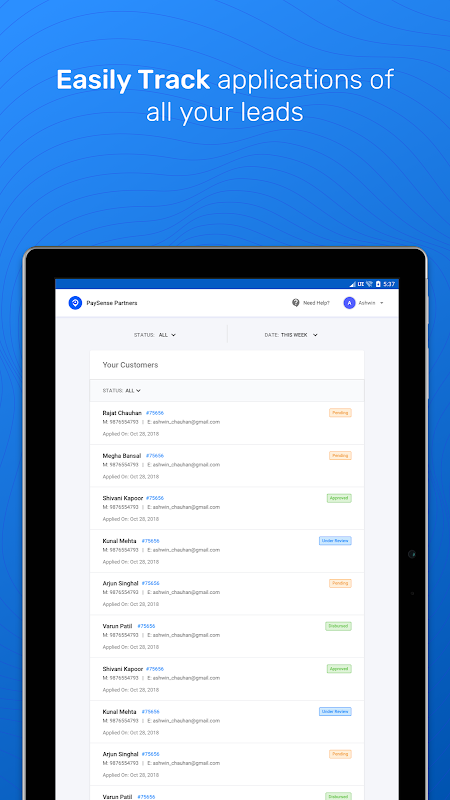

Features of PaySense Partner:

Fast and Convenient Loan Approval Process: It offers a quick and hassle-free loan approval process. Users can complete the entire loan application process within minutes, saving them valuable time and effort.

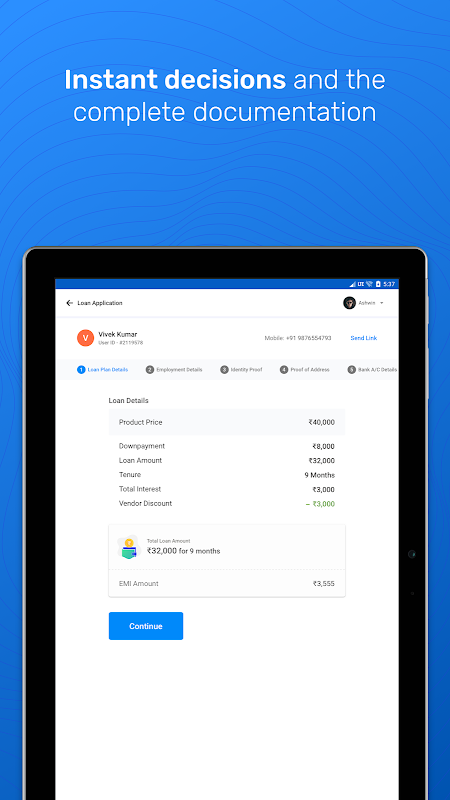

Flexible Loan Options: With it, users have access to a wide range of loan options. Whether they need a small loan for a short period or a larger loan for a longer duration, PaySense offers flexible loan terms to cater to different financial needs.

No Bureau Score or Credit Card Requirement: Unlike traditional loan providers, PaySense does not require users to have a bureau score or a credit card. This makes it easier for individuals with no credit history or poor credit scores to get access to much-needed funds.

Loan Amount and Duration: It offers loan amounts. Users can choose the loan amount based on their specific requirements. Additionally, the loan duration varies from 3 months to 60 months, allowing borrowers to select a repayment plan that suits their financial situation.

Tips for Users:

Complete your profile: To enhance your chances of loan approval, it is essential to fill out your profile completely and provide accurate information. This will help PaySense assess your eligibility accurately and expedite the loan approval process.

Choose the Right Loan Product: PaySense Partner App offers various loan products tailored to different needs. Take your time to understand the different options available and select the one that matches your financial requirements and repayment capacity.

Maintain a Good Banking History: PaySense takes into account the user's banking history while evaluating loan applications. Ensure that your bank statements reflect responsible financial behavior and regular cash flows to increase the likelihood of loan approval.

Conclusion:

With its fast and convenient loan approval process, flexible loan options, no credit card requirement, and wide range of loan amounts and durations, the PaySense Partner App is a reliable and accessible solution for individuals seeking personal loans. Whether it's for medical emergencies, education expenses, or home decor, PaySense makes it easier for users to get the funds they need without the hassle of a lengthy application process. By following the playing tips, users can maximize their chances of loan approval and make the most of this user-friendly app.

Information

- Size: 15.20 M

- Language: English

- Version: 1.0.20

- Requirements: Android

- Ratings: 95

- Package ID: com.gopaysense.android.boost.partner

- Developer: PaySense Pte. Ltd.

Top Downloads

Related Apps

Latest Update