-

Cash PaPa

- Category:Finance

- Updated:2024-08-30

- Rating: 4.1

Introduction

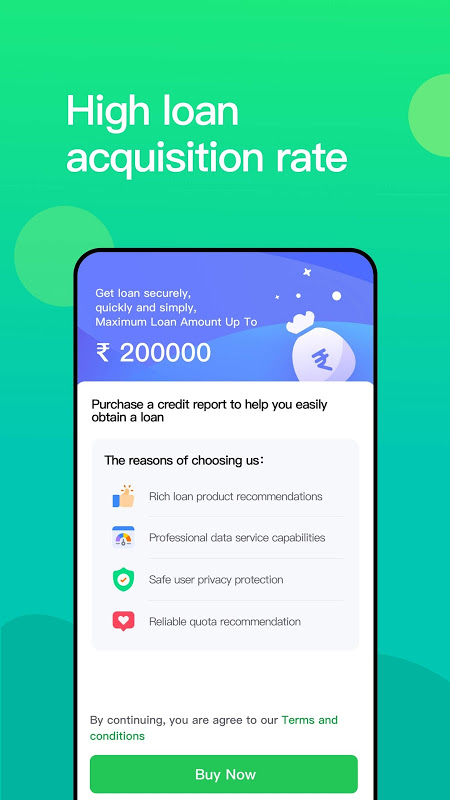

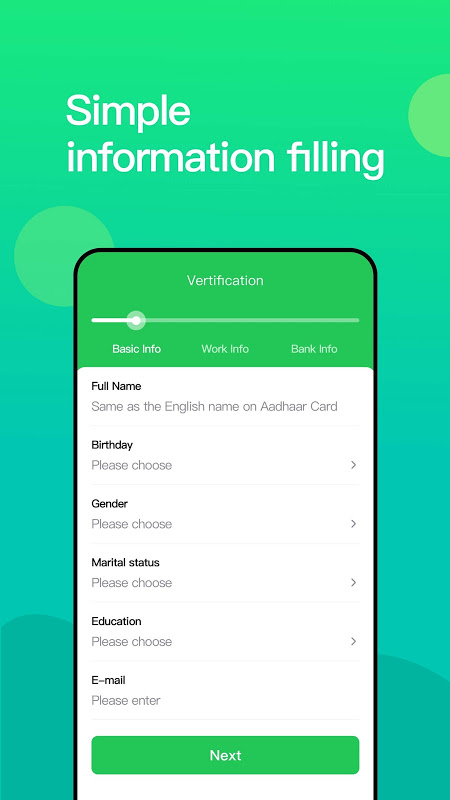

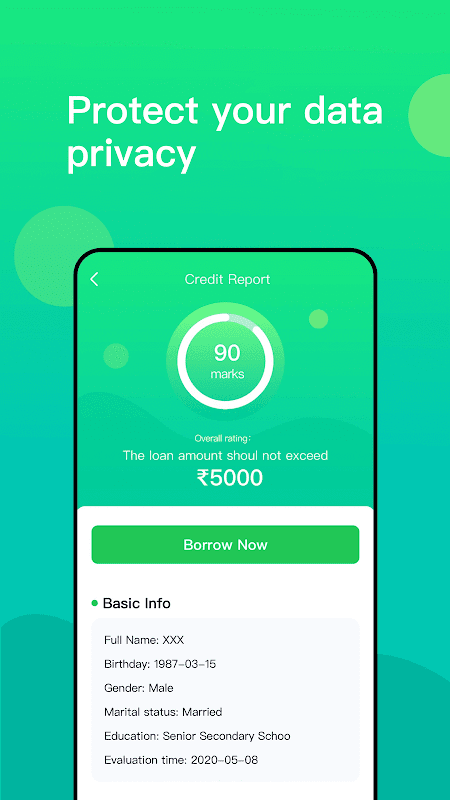

Introducing Cash PaPa, the app that offers high loan amounts of up to rs.80000 with low-interest rates starting as low as 16% and maximum rates of 30% per annum. With a loan term ranging from 120 days to 210 days, Cash PaPa provides flexibility in loan repayment. What sets us apart is our lightning-fast processing time, with a low loan threshold and a same-day audit and approval process - all done through a convenient 100% online application! Eligibility is simple, with just two requirements: being an Indian resident and aged between 22-58 years old.

Features of Cash PaPa:

⭐ High Loan Amount: With it, you can apply for loans online for amounts. This high loan amount gives you the flexibility to borrow the funds you need, whether it's for a small expense or a larger financial need.

⭐ Low-Interest Rates: It offers competitive interest rates, with annualized rates as low as 16% and a maximum rate of 30%. These low-interest rates ensure that you can borrow the funds you need without accumulating excessive interest payments.

⭐ Service Charge: The service charge for loans with Cash PaPa ranges from 4% to 9%. This affordable service charge makes it easier for borrowers to manage their loan repayment and ensures that the overall cost of borrowing remains reasonable.

⭐ Flexible Loan Repayment Term: It allows you to choose a loan repayment term that suits your needs. The loan term ranges from 120 days to 210 days, giving you the flexibility to repay the loan over a period that works for you.

Tips for Users:

⭐ Compare Interest Rates: Before applying for a loan with Cash PaPa, take the time to compare the interest rates offered by different lenders. This will ensure that you get the best possible rate and save money on interest payments.

⭐ Choose a Reasonable Loan Amount: While it offers high loan amounts, it's important to borrow only what you need. Consider your financial situation and borrow an amount that you can comfortably repay within the loan term.

⭐ Set Up Automatic Repayments: To avoid missing loan repayments, consider setting up automatic payments. This will ensure that your loan is repaid on time and help you avoid any late fees or penalties.

Conclusion:

With Cash PaPa's easy online application process and quick approval, borrowers can access the funds they need in a timely manner. The transparency of the service charge and the option to compare interest rates allows borrowers to make informed decisions. With the security measures in place, borrowers can rest assured that their personal information is protected. Whether it's for a small expense or a larger financial need, Cash PaPa provides a reliable and convenient solution for borrowing money.

Information

- Size: 7.10 M

- Language: English

- Version: 2.4.4

- Requirements: Android

- Ratings: 88

- Package ID: com.xu.pineapple.free

- Developer: Edward Adam

Top Downloads

Related Apps

Latest Update