-

koi-a

- Category:Finance

- Updated:2024-09-07

- Rating: 4.1

Introduction

Introducing koi-a, the fast online credit platform that is revolutionizing borrowing in Indonesia. With Koi Cash, anyone over the age of 21 can access quick and hassle-free loans ranging from IDR 800,000 to IDR 3,000,000. No more complications or collateral, all you need is your ID card to apply. The process is simple: download the app, fill in your data in just 5 minutes, wait for the analysis, and get your cash within 5 seconds. Koi Cash offers numerous advantages, including no need for collateral, fast submission from the comfort of your home, strict security and confidentiality, and round-the-clock customer service.

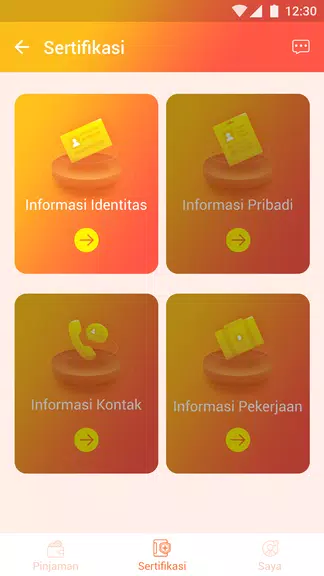

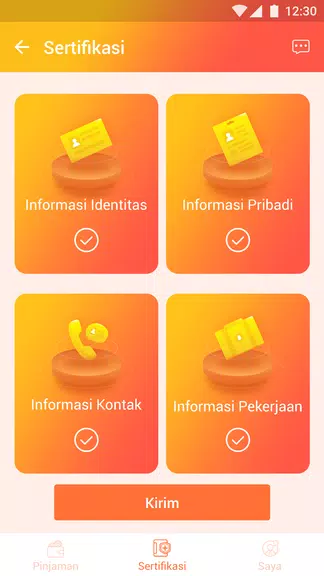

Features of koi-a:

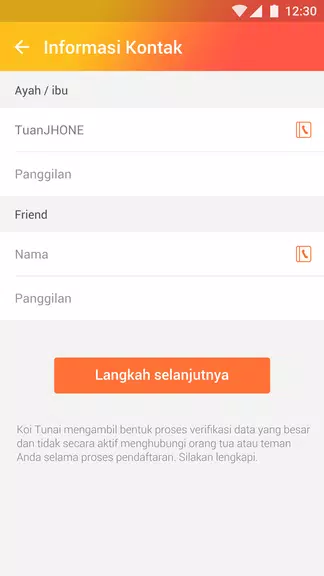

- No Collateral Required: It offers loans without the need for any collateral. All you need is your ID card to apply for a loan, making it easier and more accessible for everyone.

- Quick and Easy Process: With it, you can complete the entire loan application process within just 5 minutes. There are no complex forms to fill out, and you can do everything from the comfort of your own home using your phone.

- Fast Cash Disbursement: Once your loan is approved, you can expect to receive the cash within 5 seconds. This quick disbursement allows you to access the money you need when you need it the most.

- Data Security and Confidentiality: It prioritizes the security and confidentiality of user data. Your information is protected, and Koi-a will not disclose any data to third parties without your consent.

FAQs:

- Who is eligible to borrow from it?

It is open to all Indonesian citizens who are at least 21 years old. As long as you have a valid ID card, a mobile number, and a certain level of income, you can apply for a loan.

- Is there an interest rate for the loans?

Yes, there is an interest rate applied to the loans. The interest rate can go up to 15% per year, and there are no additional fees involved.

- What is the repayment period for the loans?

The repayment period, or tenor, for the loans offered by it ranges from a minimum of 61 days to a maximum of 120 days. The exact tenor will depend on your specific loan agreement.

Conclusion:

Koi-a is the ideal platform for Indonesians who need quick and hassle-free access to cash. With no collateral required and a simple loan application process, it offers convenience and accessibility to all borrowers. The fast cash disbursement within 5 seconds sets Koi-a apart from traditional lending institutions. Furthermore, the focus on data security and confidentiality ensures peace of mind for users. So, whether you need money for emergencies, holidays, or shopping, look no further than Koi-a. Download the app, submit your loan application, and receive the funds you need within seconds.

Information

- Size: 9.80 M

- Language: English

- Version: 1.4.0

- Requirements: Android

- Ratings: 97

- Package ID: com.koia.koi

- Developer: koi

Top Downloads

Related Apps

Latest Update