-

Funding Societies

- Category:Finance

- Updated:2024-09-12

- Rating: 4.4

- System

Introduction

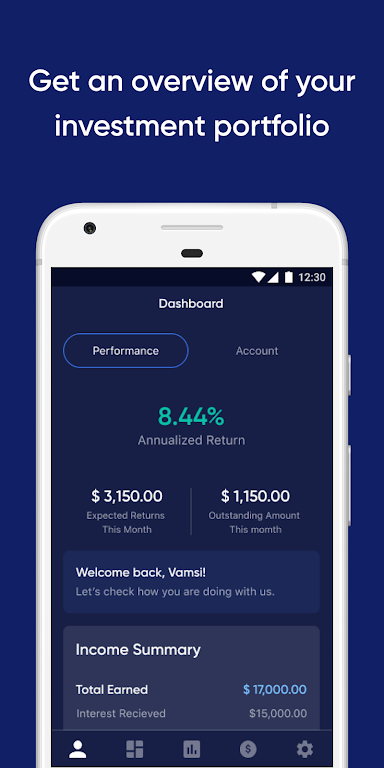

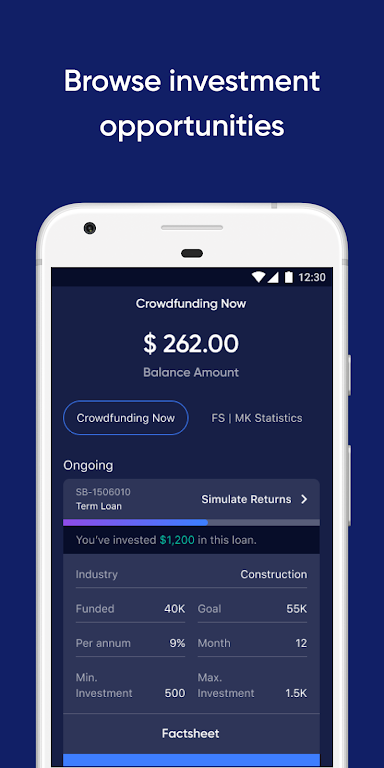

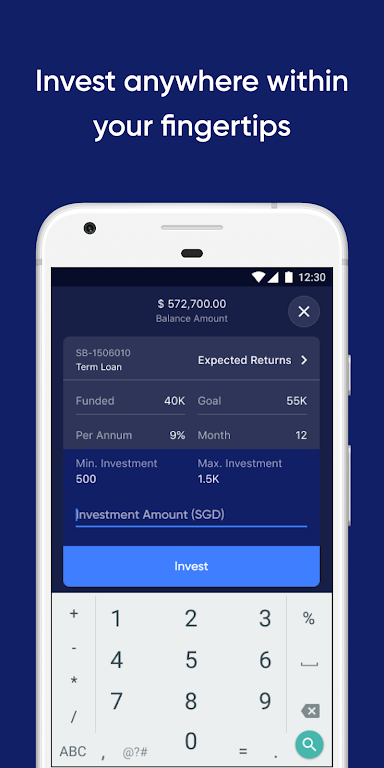

Looking for a new way to diversify your investment portfolio? Look no further than Funding Societies, the largest P2P lending platform in Southeast Asia. This innovative app allows individuals and institutions to invest in creditworthy local SMEs and earn returns in the form of interest. With it, you can start investing with as little as S$20 in Singapore, RM100 in Malaysia, or Rp100,000.00 in Indonesia. Plus, their short-term and periodic repayments make it easy to reinvest and grow your funds.

Features of Funding Societies:

- Diversify Your Investment Portfolio:

Investors have the opportunity to invest in creditworthy local SMEs, allowing them to diversify their investment portfolio. This helps reduce risk and potentially improves overall returns.

- Low Minimum Investment Amount:

With a low minimum investment amount, investors can start investing with as little as S$20 in Singapore, RM100 in Malaysia, and Rp--00 in Indonesia. This makes it accessible for both small and large-scale investors.

- Regular Repayments and Quick Re-Investment:

Most investment products on the platform offer regular repayments, allowing investors to reinvest quickly. This helps to compound returns and maximize investment growth.

- Transparent and All-Inclusive Pricing:

Funding Societies charges a simple and all-inclusive fee from the total interest earned. Investors only pay the service fee when they receive their repayments from SMEs. This pricing structure is aligned with the interests of investors.

FAQs:

- Are my investments safe?

While all investments carry risks, it takes measures to mitigate these risks. Investors' funds are kept in a 3rd party escrow account, providing an additional layer of security. It is important for investors to understand the risks involved and read the Risk Disclosure Statement.

- Is there any tax exemption for Singaporean investors?

Yes, individual Singaporean investors can enjoy tax exemption on the interest returns from year 2020 onwards. This provides an added benefit for Singaporean investors.

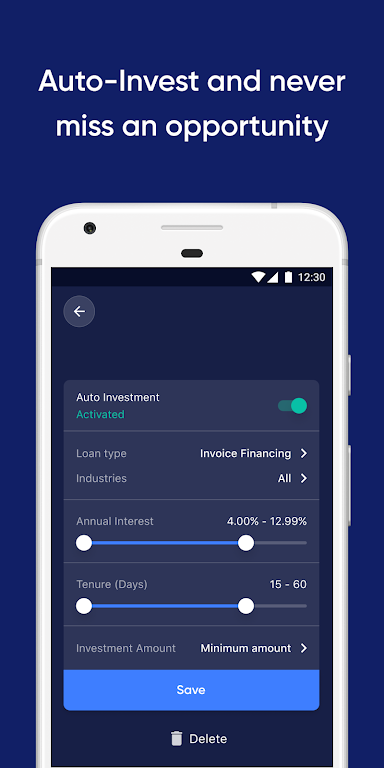

- Can I automate my investments?

Yes, it offers the option to set up Auto Invest or Planned Funding. This feature allows the system to automatically deploy funds based on your investment preferences, making investing more convenient and efficient.

Conclusion:

With Funding Societies, investors have the opportunity to diversify their portfolio by investing in creditworthy SMEs. The platform offers low minimum investment amounts, regular repayments, and the ability to automate investments. Pricing is transparent and aligned with investors' interests. While all investments carry risks, Funding Societies takes measures to safeguard investors' funds. Singaporean investors can also benefit from tax exemption on interest returns. Overall, Funding Societies provides a reliable and accessible platform for individuals and institutions looking to invest in SMEs and earn returns.

Information

- Size: 56.90 M

- Language: English

- Version: 3.5.5

- Requirements: Android

- Ratings: 100

- Package ID: com.fundingsocieties.fundingsocieties

- Developer: Funding Asia Group

Explore More

Top Downloads

Related Apps

Latest Update