-

NIRA Instant Personal Loan App

- Category:Finance

- Updated:2024-09-21

- Rating: 4.2

Introduction

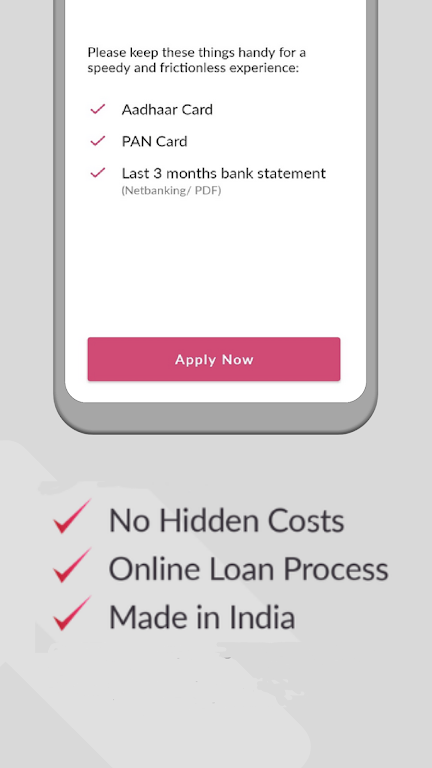

Tired of being strapped for cash? Look no further than the NIRA Instant Personal Loan App! This game-changing app offers quick and low-interest personal loans to help you get back on your feet. With a simple and hassle-free application process, you can borrow anywhere from Rs 5,000 to Rs 1,500,000 in no time. NIRA's flexible repayment options allow you to repay your loan over 3 to 24 months, making it convenient for you. Plus, their competitive Annual Percentage Rates (APR) ensure that you're getting the best deal possible.

Features of NIRA Instant Personal Loan App:

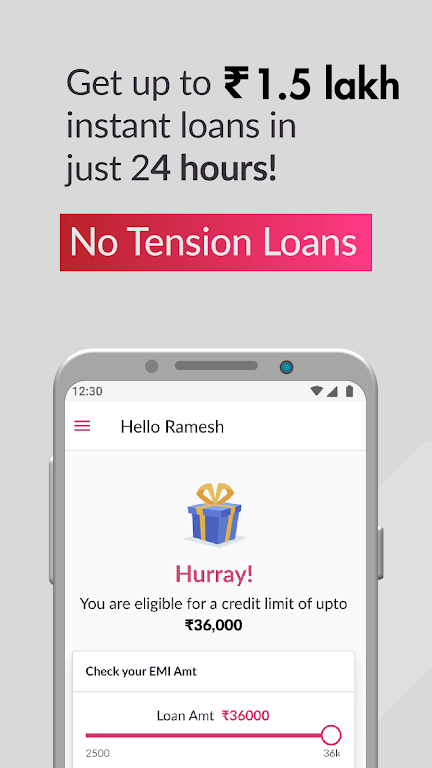

- Instant Loan Amount: With the NIRA Loan App, you can borrow money swiftly. Whether you need a small online loan of as low as Rs 5,000 or a higher amount up to Rs 1,500,000 we have you covered.

- Flexible Repayment: We understand that everyone has different financial situations. That's why our loan app allows you to repay your cash loan through easy monthly installments (EMI) over a period of 3 to 24 months. This flexibility ensures that you can manage your repayments comfortably.

- Competitive APR: At NIRA, we believe in offering our customers the best interest rates. Enjoy competitive Annual Percentage Rates (APR) ranging from a minimum of 24% to a maximum of 36% (reducing balance). This helps you save money and pay off your loan faster.

- Prepayment Flexibility: We value your financial freedom. With our online personal loan app, you can make prepayments without any fees within 7 days of loan disbursement. However, a 4% prepayment fee applies if you choose to make a prepayment after 7 days.

Tips for Users:

- Be Mindful of Late Payments: While we understand that financial setbacks happen, it's essential to make your loan repayments on time. NIRA offers a late payment policy where no extra fees apply for up to 30 days of late payments. However, after 30 days, a nominal late fee of Rs. 500 may apply.

- Consider the Total Cost of the Loan: When borrowing money, it's crucial to factor in the total cost of the loan. Understanding the principal amount, interest rate, processing fees, and any late payment fees will help you make informed financial decisions.

- Utilize the Prepayment Option: If you have extra funds, consider making prepayments on your loan. This will help you reduce the overall interest amount and enable you to become debt-free sooner.

Conclusion:

The NIRA Instant Personal Loan App offers a convenient and reliable solution for individuals in need of quick and low-interest personal loans. With features like instant loan amounts, flexible repayment options, competitive APR, and prepayment flexibility, NIRA ensures that you have the financial assistance you need without any hassle. Furthermore, our collaboration with trusted lending partners and adherence to the Digital Lenders Association of India (DLAI) code of conduct highlights our commitment to responsible lending. Download the NIRA Loan App today and experience a seamless borrowing experience.

Information

- Size: 119.50 M

- Language: English

- Version: 7.6.8

- Requirements: Android

- Ratings: 4

- Package ID: com.nirafinance.customer

- Developer: NIRA

Top Downloads

Related Apps

Latest Update