-

Akseleran - Pendanaan UKM

- Category:Finance

- Updated:2024-10-11

- Rating: 4.4

Introduction

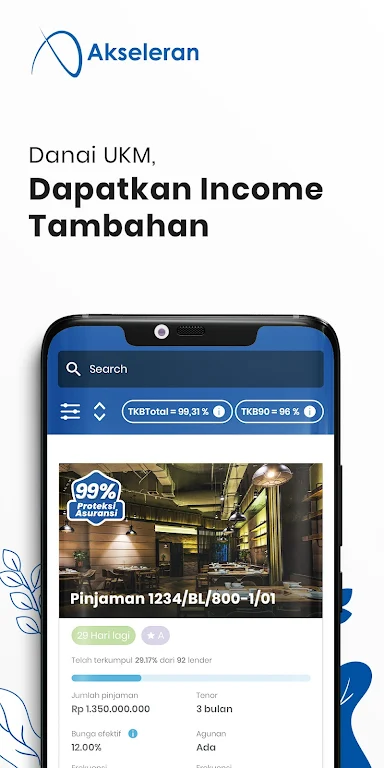

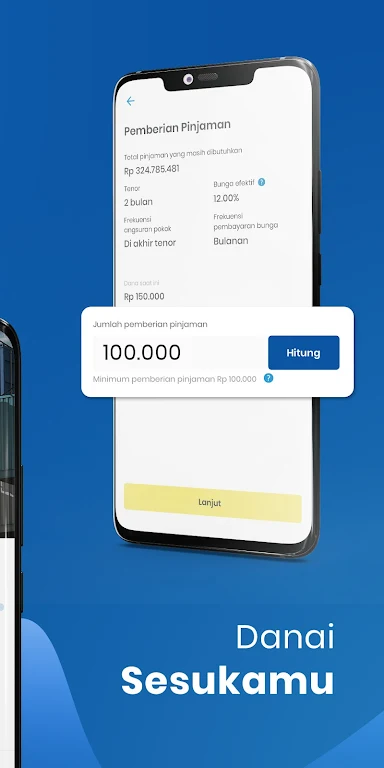

Are you tired of limited funding options for your small business? Look at Akseleran - Pendanaan UKM, the groundbreaking fintech crowdfunding platform in Indonesia. Akseleran connects small and medium-sized enterprises (SMEs) with eager crowd lenders who are ready to finance their businesses' growth. With Akseleran, obtaining affordable loans has never been easier. There are no additional fees, and you can start with as little as IDR 100,000. Don't wait any longer – empower your financial and business future with Akseleran!

Features of Akseleran - Pendanaan UKM:

> Easy Access to Affordable Loans: It offers loans with affordable initial funds starting from IDR 100 thousand. This makes it easy for lenders to develop their funds without additional fees. The platform can be accessed from anywhere, anytime, and follows an easy concept.

> Reliable and Regulated Platform: It is registered and supervised by the Financial Services Authority (OJK). It has obtained a full operational permit and follows a rigorous process of evaluating the financial condition of SMEs. Additionally, insurance protects 99% of the loan principal in arrears.

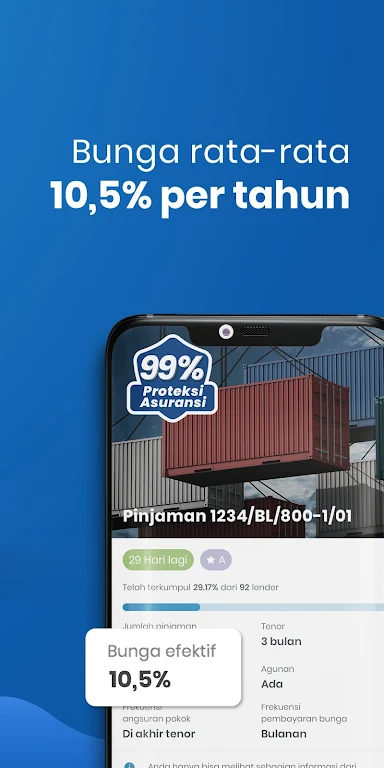

> Higher Interest Rates: With Akseleran, lenders can earn an average interest of 9.5% to 10.% per year. This is higher than some conventional investment instruments, providing an opportunity for increased income.

> Competitive Rates and Flexible Collateral: It offers competitive interest rates to SMEs applying for loans. Collateral options include invoices, inventory, and contracts, eliminating the need for fixed assets.

Tips for Users:

> Diversify your Investments: To maximize returns and minimize risks, diversify your investments across multiple SMEs on Akseleran. This will provide a balanced portfolio and protect your funds.

> Assess the Financial Health of SMEs: Before lending to an SME, carefully evaluate its financial condition. Look for companies with solid business plans, positive cash flow, and a good track record. This will increase the chances of successful repayment.

> Stay Updated on Market Trends: Keep an eye on market trends and economic indicators to make informed investment decisions. This will help you identify opportunities and better understand the risks involved.

Conclusion:

Akseleran - Pendanaan UKM is a reliable and regulated P2P lending platform in Indonesia that offers lenders affordable loans and an opportunity to earn higher interest rates. With easy access to loans and an easy concept, it is a convenient solution for lenders looking to develop their funds. The platform is supervised by the Financial Services Authority and has insurance coverage to protect lenders' funds. With competitive rates, flexible collateral options, and a rigorous evaluation process, Akseleran is a trusted platform for both lenders and SMEs. Start #BERANIAKSELERASI by providing loans or applying for a loan through Akseleran for a faster financial and business future.

Information

- Size: 20.80 M

- Language: English

- Version: 3.22.8

- Requirements: Android

- Ratings: 75

- Package ID: com.akseleran.crowdfund

- Developer: PT. Akseleran Keuangan Inklusif Indonesia

Top Downloads

Related Apps

Latest Update