-

Kreditzy Personal Loan App

- Category:Finance

- Updated:2024-11-01

- Rating: 4

Introduction

Kreditzy Personal Loan App, the Personal Loan App designed for Indian mobile users, is the ultimate solution for all your financial needs. With just a few taps on your screen, you can access fair and affordable online loans in a quick and convenient way. The entire application process takes as little as 10 minutes, and once approved, the loan amount is instantly transferred to your bank account. Rest assured, Kreditzy works solely with registered NBFCs/Banks approved by RBI, ensuring your loans are approved and sanctioned by reputable institutions.

Features of Kreditzy Personal Loan App:

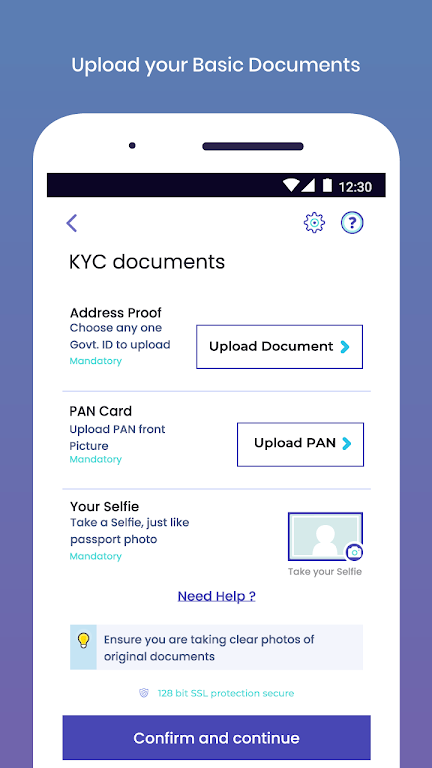

> 100% Online Process: With Kreditzy, you can complete the entire loan application process online, without the need for any physical documentation or visits to a bank branch. This saves you time and effort, making it a convenient option for busy individuals.

> Fast Approval: It offers fast approval for personal loans, ensuring that you receive a decision on your application quickly. This means you can get the funds you need without any unnecessary delays, allowing you to address your financial needs promptly.

> Immediate Bank Transfer: Once your loan application is approved, Kreditzy ensures that the funds are immediately transferred to your bank account. This enables you to access the money instantly and use it for your intended purpose, whether it's paying off debts, managing unexpected expenses, or pursuing your goals.

> Affordable Interest Rates: It provides fair and affordable interest rates on personal loans. By offering a range of interest rates from 0% to 29.95% per annum, Kreditzy aims to cater to borrowers with varying credit profiles and financial needs. This ensures that you can find a loan option that suits your requirements and budget.

FAQs:

> Who is eligible to apply for a loan on Kreditzy?

To be eligible for a loan on it, you need to be an Indian resident, above the age of 21 years, and have a monthly source of income. Meeting these criteria ensures that you have a stable financial background and are capable of repaying the loan.

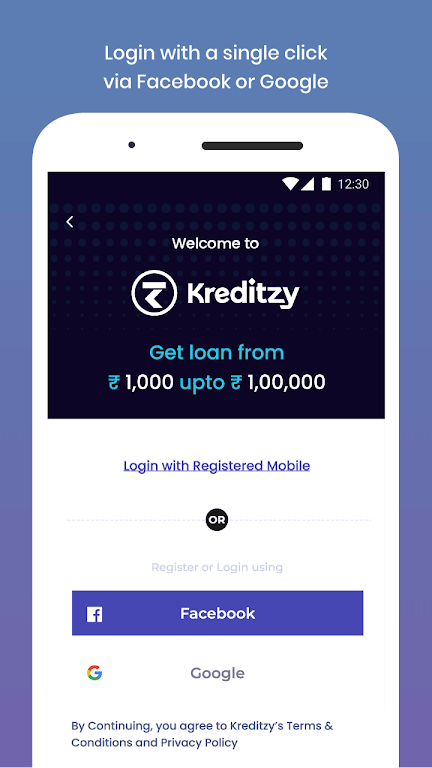

> How do I get started with it?

To get started with it, simply install the app from the Playstore, register, and create a new account. Fill out your basic information, submit the application, and wait for the final eligibility to be shown in the app. After approval, select the loan product that suits you and e-sign the loan agreement. The approved loan amount will be disbursed into your account within 5 minutes.

> Are there any additional charges or fees?

It charges a one-time service fee during onboarding or upgrade, ranging from ₹20 to ₹350 depending on your risk profile and membership band. There is also a small processing fee charged for loans, which varies based on your creditworthiness and repayment ability. Additionally, GST is applicable only on the fee components as per Indian laws.

Conclusion:

Get access to fair and affordable personal loans in a fast and convenient way with Kreditzy Personal Loan App. With a 100% online process, fast approval, and immediate bank transfer, Kreditzy ensures that you can meet your financial needs without any hassle or delays. The app caters to Indian residents above the age of 21 years who have a reliable source of income. With transparent fees and charges, Kreditzy offers attractive interest rates ranging from 0% to 29.95% per annum. Download the Kreditzy app today and experience hassle-free borrowing.

Information

- Size: 9.20 M

- Language: English

- Version: 1.2.8

- Requirements: Android

- Ratings: 81

- Package ID: com.kreditzy.android

- Developer: KartBee Technologies

Top Downloads

Related Apps

Latest Update