-

Eduvanz- Quick education loans

- Category:Finance

- Updated:2024-11-13

- Rating: 4.2

Introduction

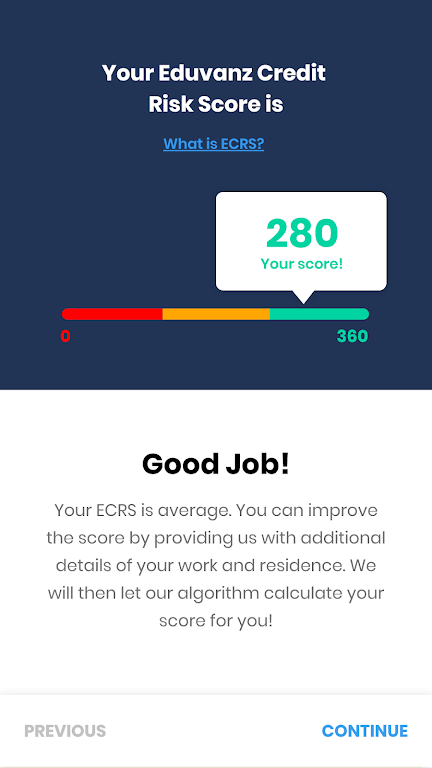

Look no further than Eduvanz- Quick education loans! Looking for a quick and hassle-free loan to pursue your educational dreams or purchase a device to help you earn? As a trusted and licensed NBFC and fintech platform, Eduvanz has been serving millions of learners in India. With just a few clicks, you can secure a loan ranging from 15,000 to 10,00,000 INR to kickstart your learning journey. Our fully online loan process ensures minimal documentation and fast disbursals, giving you instant access to quality courses offered by our 1000+ educational partners across India.

Features of Eduvanz- Quick education loans:

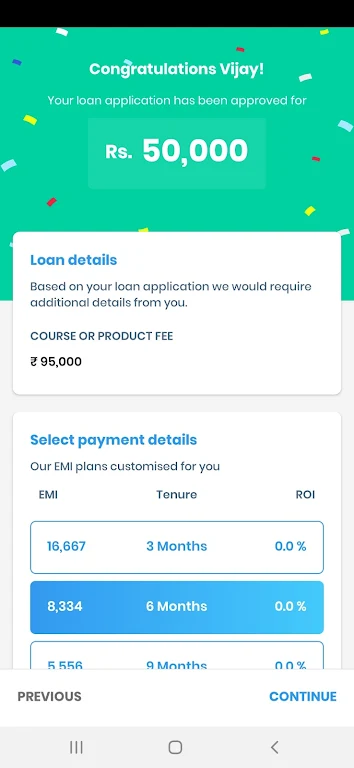

Quick Loan Process: Eduvanz offers a quick loan process, allowing borrowers to receive funds between 15,000 to 10,00,000 INR instantly. This ensures that learners can begin their educational journey without delay.

Online Application: With Eduvanz, the loan application process is 100% online. Borrowers can conveniently submit their application form through the mobile app or website, saving time and effort.

Wide Range of Courses: Eduvanz has partnered with over 1000 educational institutions and merchants across India, providing borrowers with access to a wide range of quality courses. This ensures that learners can pursue the educational programs that suit their needs and aspirations.

Low-cost Loans and Flexible Tenures: Eduvanz offers student-friendly loans with low interest rates ranging from 0% to 36% per annum. Additionally, borrowers can enjoy flexible tenures, allowing them to repay the loan at their own pace.

Tips for Users:

Gather Required Documents: Before applying for a loan, gather all the necessary documents such as identification proof, address proof, and income proof. This will speed up the loan approval process.

Compare Interest Rates and Tenures: Explore and compare the interest rates and tenure options offered by Eduvanz to find the most suitable loan for your educational needs. Consider factors such as affordability and repayment capacity.

Read Terms and Conditions: Before accepting a loan offer, carefully read the terms and conditions provided by Eduvanz. Pay attention to details such as processing fees, hidden charges, and repayment terms to avoid any surprises.

Conclusion:

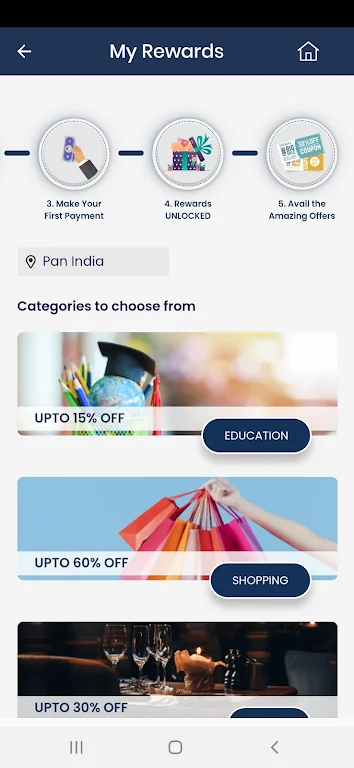

Eduvanz- Quick Education Loans is a convenient and user-friendly app that enables individuals to access quick loans for their education-related needs. With a seamless online application process, borrowers can apply for loans anytime, anywhere. The wide range of educational partners ensures access to quality courses, and the low-cost loans with flexible tenures make repayment more manageable. Whether you need to finance a course or purchase a device/vehicle to support your learning, Eduvanz provides a reliable solution. Install the app today to kickstart your learning journey without any financial hurdles.

Information

- Size: 24.90 M

- Language: English

- Version: 11.0.9.5

- Requirements: Android

- Ratings: 18

- Package ID: com.eduvanzapplication

- Developer: Eduvanz Financing Pvt. Ltd.

Top Downloads

Related Apps

Latest Update