-

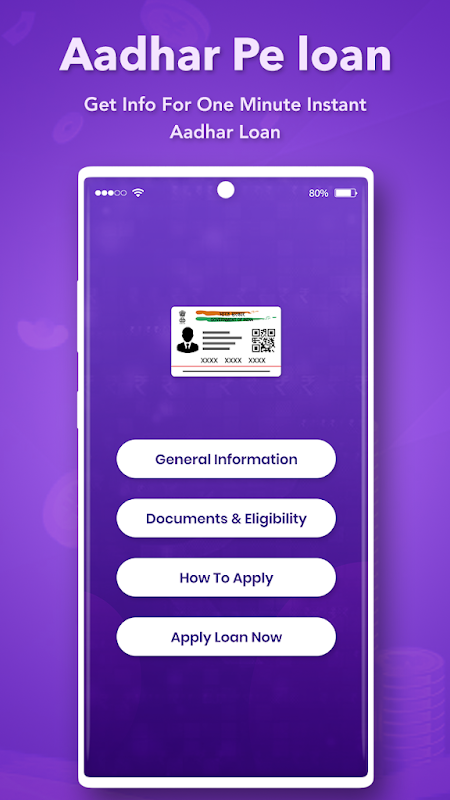

Get Loan on Aadhar Card Guide

- Category:Finance

- Updated:2024-12-03

- Rating: 4.5

Introduction

Introducing the Get Loan on Aadhar Card Guide, your ultimate tool for getting loans online with minimal documentation. With this mobile guide, you'll have access to all the information you need to secure personal loans, home loans, education loans, credit card loans, business loans, gold loans, and even car and bike loans. Whether you need a loan ranging from ₹2,000 to ₹1,00,000, with a loan period of 91 to 180 days, we've got you covered. Our app calculates the interest payable and processing fees, ensuring you have a clear understanding of the loan terms.

Features of Get Loan on Aadhar Card Guide:

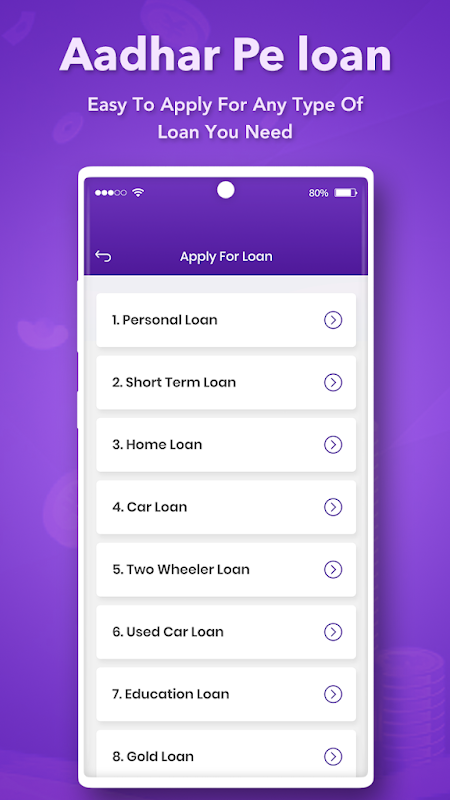

* Comprehensive Guide: The Loan Guide App provides all the necessary information regarding different types of loans, including personal loans, home loans, education loans, credit card loans, business loans, gold loans, and car loans. Users can access detailed guides on each type of loan, making it a one-stop resource for all their loan-related queries.

* Loan Amount: With the Loan Guide App, users can apply for loans ranging from ₹2,000 to ₹1,00,000. This flexibility allows borrowers to choose an amount that suits their financial needs, whether it's a small loan for emergencies or a larger loan for major expenses.

* Loan Period: The app offers loan periods ranging from 91 to 180 days. This means borrowers can select a repayment period that aligns with their financial capabilities and preferences. Users can decide whether they want to repay the loan quickly or prefer a more extended repayment period.

* Interest Calculation: The Loan Guide App provides users with a transparent and easy-to-understand interest calculation. For example, if a borrower takes a loan amount of ₹1,00,000 with an interest rate of 30% per annum and a tenure of 91 days, the app calculates the interest payable with precision, taking into account processing fees and applicable taxes.

Tips for Users:

* Compare Offers: To make the most informed decision, use the Loan Guide App to compare offers from different lenders. This will help you find the most favorable terms and interest rates, ensuring that you get the best deal possible.

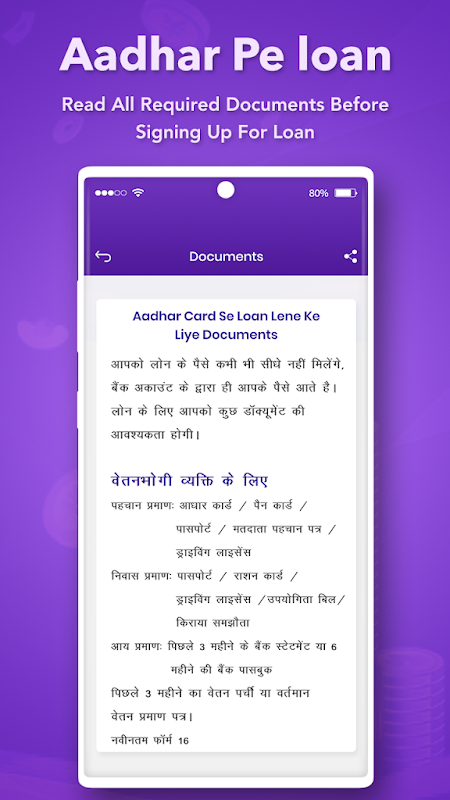

* Understand Terms and Conditions: Carefully read and understand the terms and conditions associated with each loan type. The Loan Guide App provides detailed information on the requirements, documents needed, and application process for each loan, ensuring that you are well-informed before proceeding with your loan application.

* Maintain a Good Credit Score: A good credit score plays a significant role in loan approvals. Use the Loan Guide App to learn how to maintain a healthy credit score by paying bills and debts on time, avoiding unnecessary credit inquiries, and keeping credit utilization low.

Conclusion:

Get Loan on Aadhar Card Guide is a comprehensive and user-friendly resource that provides individuals with the necessary information to make informed decisions about loans. With its extensive coverage of different types of loans, users can easily understand the requirements, application process, and repayment terms for each loan category. The app's features, such as flexible loan amounts and repayment periods, transparent interest calculations, and playing tips, ensure that users can navigate the loan process confidently. Download the Loan Guide App today to access a wealth of knowledge and take advantage of the benefits it offers in securing loans with minimum documentation.

Information

- Size: 10.00 M

- Language: English

- Version: 1.0.6

- Requirements: Android

- Ratings: 2

- Package ID: com.secandamadluynase.maduylnabijana

- Developer: Avizan finse

Top Downloads

Related Apps

Latest Update