-

LOAN CREDIT PLANNER : FINANCIAL CALCULATOR

- Category:Finance

- Updated:2024-12-04

- Rating: 4

Introduction

LOAN CREDIT PLANNER : FINANCIAL CALCULATOR simplifies your personal financial planning. With its easy-to-use interface, you can effortlessly calculate your loan repayments, interest rates, and monthly installments. Whether you're planning to purchase a new car or invest in property, this app provides accurate projections and valuable insights to help you make informed decisions. It also features an intuitive budget planner that allows you to track your income, expenses, and savings goals, enabling you to effectively manage your finances. Download the app now!

Features of LOAN CREDIT PLANNER : FINANCIAL CALCULATOR:

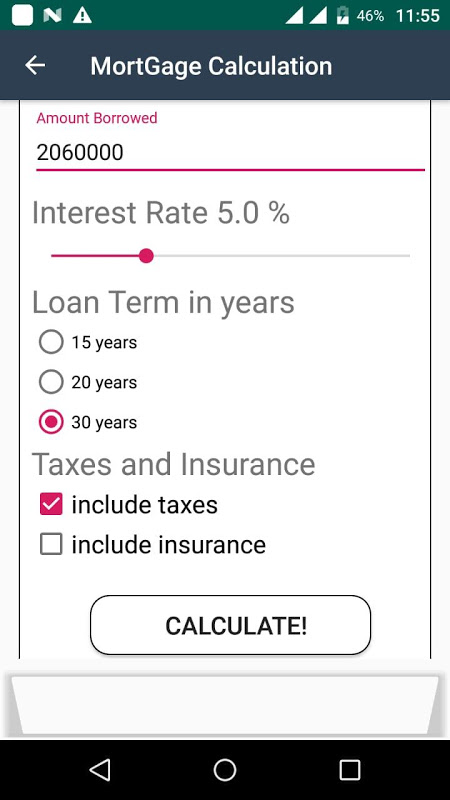

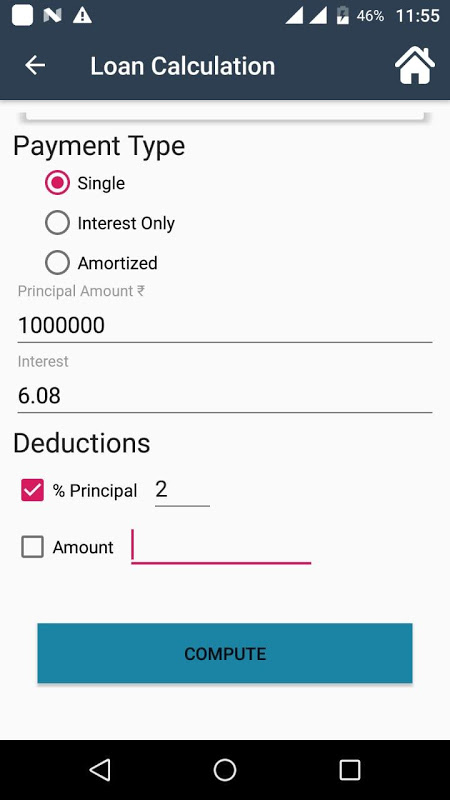

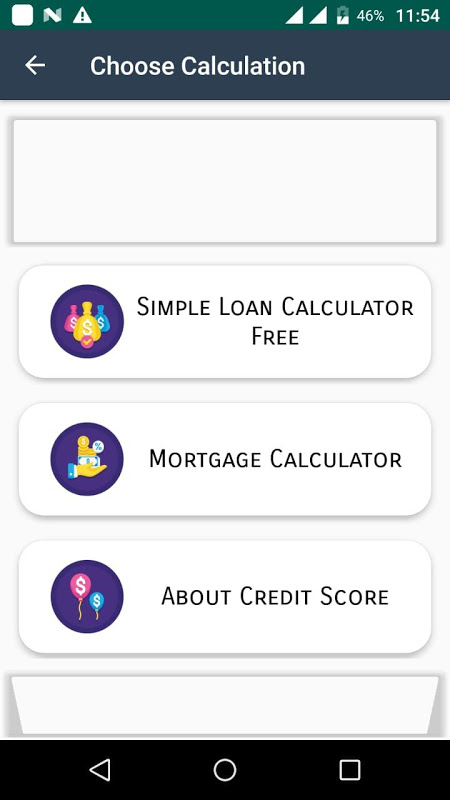

- Loan Calculator: With Loan Credit Planner, you can easily calculate the monthly installment, total interest, and total repayment amount for any type of loan. This feature helps you plan your loan repayment effectively and make informed decisions when borrowing money.

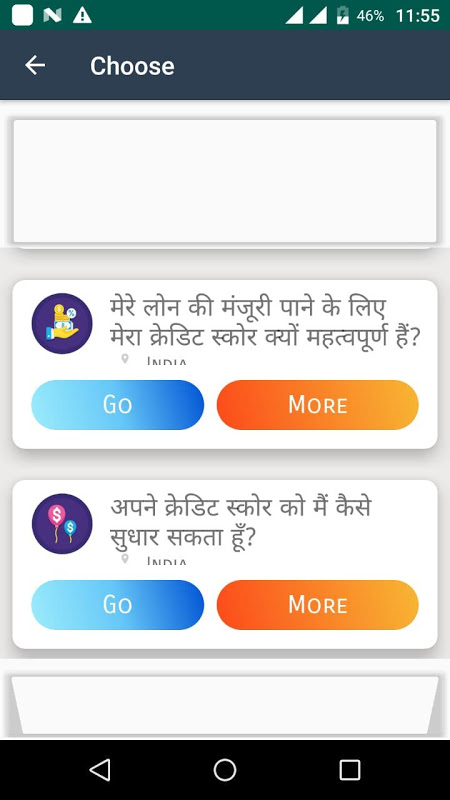

- Multiple Loan Types: This app supports various loan types such as personal loans, home loans, car loans, and student loans. No matter what type of loan you need, Loan Credit Planner has got you covered.

- Detailed Amortization Schedule: Loan Credit Planner provides a comprehensive amortization schedule, allowing you to see the breakdown of each payment over the loan term. This helps you visualize how much of each payment goes towards the principal and interest, enabling you to manage your finances better.

- Comparison Tool: Want to compare different loan options? Loan Credit Planner comes with a handy comparison tool that allows you to compare the total interest and repayment amount for multiple loan scenarios. This feature helps you make a side-by-side comparison and choose the loan that best suits your needs.

Tips for Users:

- Customize Loan Parameters: Make sure to input the accurate loan amount, interest rate, and loan term to get the most precise calculations. This ensures that you have a realistic understanding of your loan repayment plan.

- Use the Amortization Schedule Wisely: Take advantage of the detailed amortization schedule to see how each payment affects your loan balance. By analyzing this information, you can decide if making extra payments or increasing the repayment amount can help you save on interest and repay your loan faster.

- Compare Loan Options: Before finalizing a loan, use the comparison tool to explore different scenarios. Adjust the loan amount, interest rate, and term to see how they impact your repayment. This way, you can find the most cost-effective loan option and save money in the long run.

Conclusion:

LOAN CREDIT PLANNER : FINANCIAL CALCULATOR is a must-have app for anyone who wants to stay on top of their financial planning and make informed decisions about loans. With its intuitive loan calculator, support for multiple loan types, detailed amortization schedule, and comparison tool, this app provides all the necessary features to manage your loans effectively. By following the provided playing tips, users can maximize the benefits of this app and save money on interest payments. Download Loan Credit Planner now and take control of your financial future.

Information

- Size: 6.20 M

- Language: English

- Version: 1.0

- Requirements: Android

- Ratings: 49

- Package ID: eudhar.ecalc.checklon.getresult

- Developer: CONFIRM BAT