-

Credit Card Reader

- Category:Finance

- Updated:2024-12-03

- Rating: 4.3

- System

Introduction

In a world where credit card use is rampant, it's no surprise that businesses of all sizes are turning to mobile Credit Card Reader. These affordable devices are a cost-effective alternative to stationary credit card machines, with transaction fees often being less than 3 percent. Not only are they easy to use, but they also come with numerous features and capabilities that traditional machines lack. Mobile readers are especially beneficial for businesses on the go, allowing them to accept credit and debit cards wherever they may be. Download the app now!

Features of Credit Card Reader:

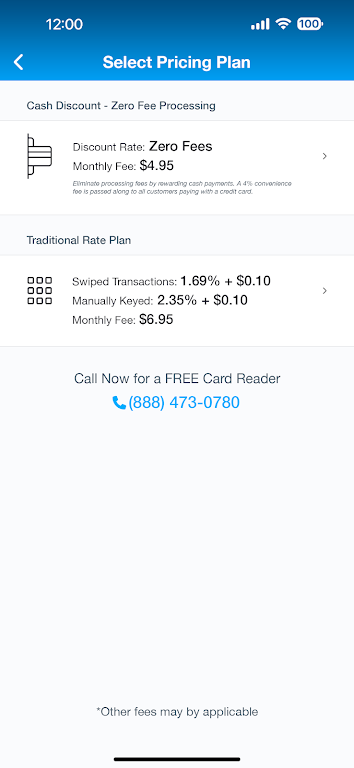

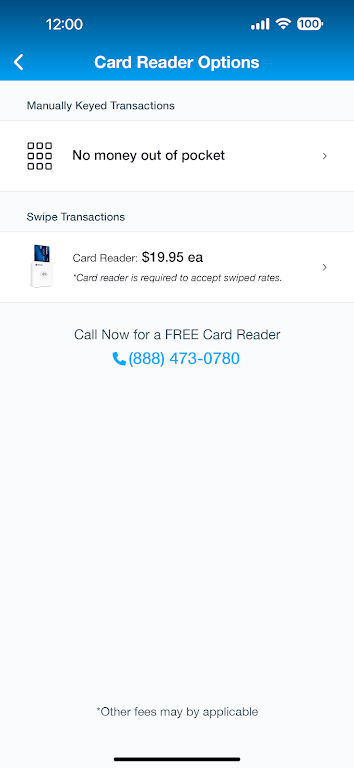

> Affordable: Mobile credit card machines are highly cost-effective, with transaction fees generally less than 3 percent. This makes them a more affordable option compared to stationary counterparts.

> Ease of Use: Mobile credit card readers are easy to operate, allowing for payments to be made almost immediately after setup. Quality options work across multiple platforms, making them convenient for users.

> Numerous Features and Capabilities: Unlike traditional credit card machines, mobile readers offer a variety of features and capabilities. Users can run reports, track transactions and receipts, and customize their systems to fit their needs.

> Flexibility: Mobile credit card terminals are ideal for business owners who frequently travel or operate on the road. They can accept credit and debit cards, increasing their customer base and revenue opportunities.

> Validity: Using a mobile credit card swiper helps small businesses appear more established and valid to customers. Studies show that customers trust and perceive a company as more legitimate when they use credit card readers.

FAQs:

> How much do mobile credit card machines cost?

Mobile credit card machines are more affordable compared to stationary counterparts. Transaction fees are generally less than 3 percent.

> Are it easy to use?

Yes, it is easy to operate. Quality options allow for immediate payments after setup, and they work across multiple platforms.

> Can it track transactions and keep records?

Yes, it can run reports, track transactions, and automatically save each card swipe to the user's mobile POS account. This makes it easier to track fraudulent charges and manage receipts.

> Who can benefit from using mobile credit card terminals?

Business owners who frequently travel, operate on the road, or participate in trade shows and festivals can benefit from using mobile credit card terminals. It allows them to accept credit and debit cards, increasing their customer base.

Conclusion:

Switching to a mobile credit card swiper or adding one to your business offers numerous advantages. Credit Card Reader are affordable, easy to use, and offer a wide range of features and capabilities. Mobile credit card terminals provide flexibility for businesses that operate on the road and help establish trust and validity with customers. Additionally, they offer multiple transaction options, eliminating the need for manual entry and reducing the risk of lost revenue. Overall, investing in a mobile credit card swiper is a smart decision for businesses looking to expand their payment options and improve customer satisfaction.

Information

- Size: 4.80 M

- Language: English

- Version: 24.7.12

- Requirements: Android

- Ratings: 15

- Package ID: com.ics.creditcardreader

- Developer: Merchant Account Solutions

Explore More

Top Downloads

Related Apps

Latest Update